Handle invoicing, tax compliance, and VAT verification, simplifying financial management

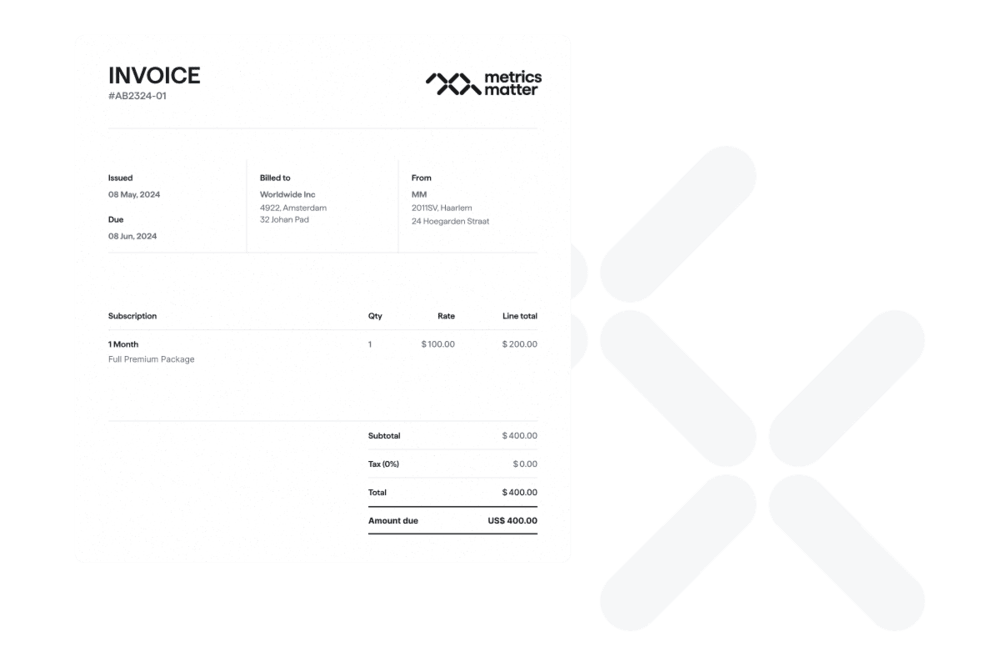

Generate invoices for all customer payments, whether one-time or recurring, ensuring accurate financial documentation and simplified financials.

Automatic invoice creation

We generate invoices on your behalf for all payments received from customers, whether they are one-time or recurring.

- Comprehensive Invoice Generation: Takes responsibility for generating invoices for all customer payments.

- Accurate Documentation: Ensures accurate and complete documentation of financial transactions.

- Simplified Financial Management: Handles invoicing to simplify your financial management processes.

- Enhanced Transparency: Improves transparency in financial transactions for both you and your customers.

- Positive Billing Experience: Promotes a positive billing experience with clear and professional invoices.

Custom branding

Personalize invoices by incorporating your logo and branding elements.

- Brand Identity Customization: Allows for tailored invoices with your logo and branding elements.

- Professional Appearance: Enhances the professional appearance of your invoices.

- Brand Visibility: Reinforces your brand's visibility and recognition.

- Lasting Impression: Helps make a lasting impression on customers through consistent branding.

- Polished Image: Maintains a polished image in financial transactions.

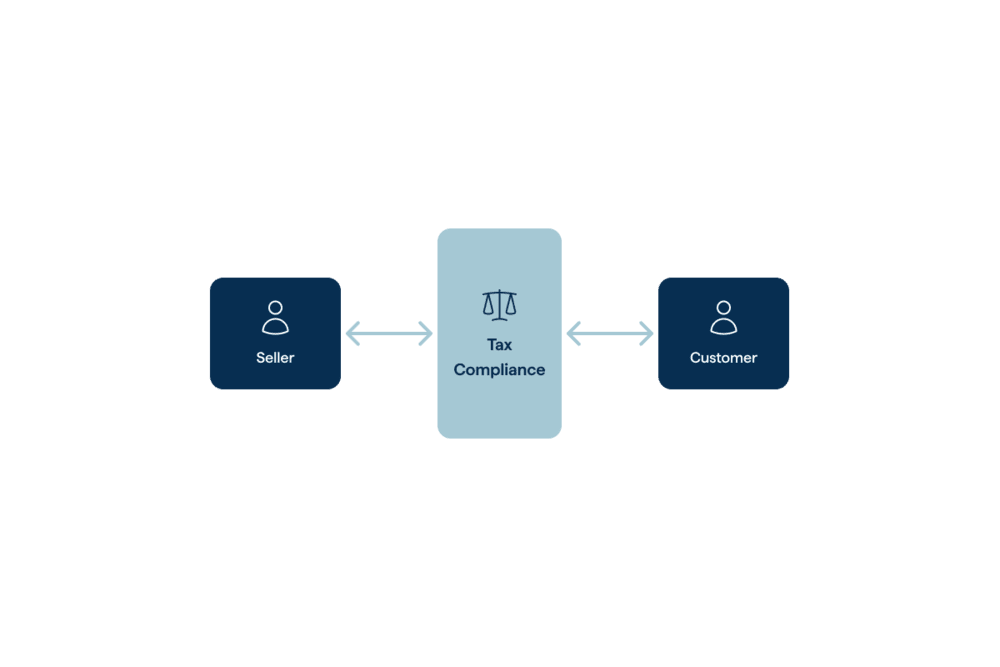

Global Tax Compliance

Expand your product sales to a global scale, and let us handle worldwide tax compliance on your behalf

- Global Expansion: Enables global product sales.

- Worldwide Tax Management: Manages tax compliance across the world.

- Simplified International Sales: Provides a simplified approach to international sales.

- Focus on Growth: Allows you to focus on business growth.

- Cross-Border Taxation: Reduces challenges with cross-border taxation.

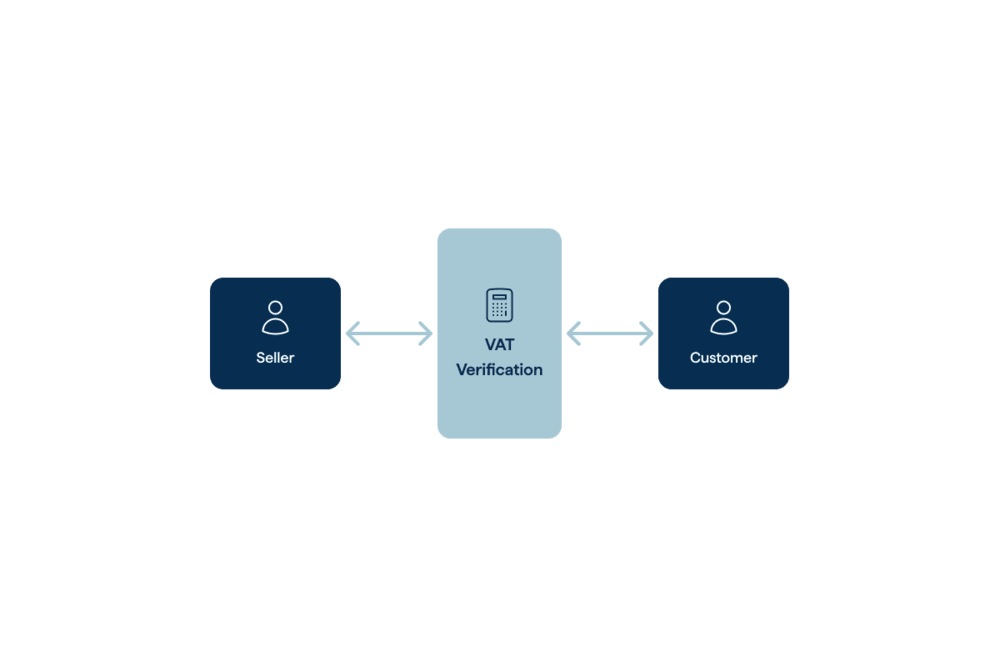

VAT number verification

Ensure the accuracy of business VAT numbers for compliance with the reverse charge mechanism and zero-rated cross-border sales of goods within the EU.

- VAT Number Verification: Ensures the accuracy of business VAT numbers.

- Compliance with EU Tax Regulations: Maintains compliance with EU tax regulations.

- Facilitates Cross-Border Sales: Streamlines cross-border transactions.

- Minimizes Tax-Related Issues: Reduces the risk of tax-related problems.

- Legally Sound Operations: Ensures legally sound cross-border sales within the EU market.